4. Risk Management #

Risk = Likelihood X Impact #

A componenent-driven approach requires the risk analyst to assess three elements of risk: threat, vulnerability, and impact.

Threat is the individual, group, or circumstance which causes a given impact to occur, e.g. lone hacker, state-sponsered group, staff member who has made a mistake, or high-impact weather.

The purpose of assessing threat is to improve the assessment of how likely a given risk is to be realised.

IS Risk Methods and Frameworks #

Risk Assessment Methods/Frameworks:

- NIST 800-3

- ISO/IEC 27005

- ISACA COBIT

- ISF IRAM 2

- HMG Information Assurance Standard 1 2

- Octave Allegro

- ISACA COBIT 5

IS Management Frameworks:

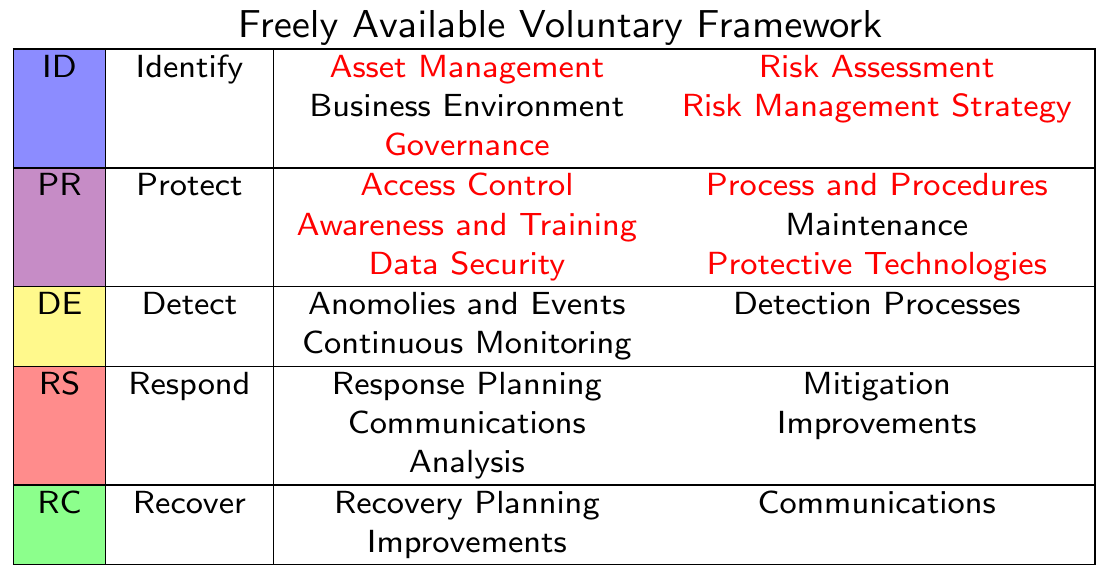

- NIST CSF

- ISO/IEC 27000 series

NIST Cyber Security Framework #

Risk Assessment Steps #

- Identify:

- Assets

- Threats

- Existing Controls

- Vulnerabilities

- Consequences

- Analyse:

- Assessment of consequences

- Assessment of incident likelihood

- Level of risk determination

- Treat:

- Risk modification

- Risk retention

- Risk avoidance

- Risk sharing

- Monitor:

- Monitoring and review

Qualitative Risk Analysis #

Uses scale of qualifying attributes to describe magnitude of consequences/likelihood.

- Advantage: Ease of understanding by all relevant personnel

- Disadvantage: Dependence on subjective choice of the scale

- May be used:

- As initial screening, to identify risks requring detailed analysis

- Where the analysis is sufficient for decisions

- Where numerical data/resources inadequate for quantitative analysis

Quantitative Risk Analysis #

Uses scale of objective numerical values for consequences/likelihood.

- Uses data from a variety of sources

- Quality of analysis depends on accuracy/completeness of numerical data

- Typically uses historial incident data:

- Advantage: Related directly to IS objectives/concerns of organisation

- Disadvantages: Lack of data on new risks, accurate/missing data in general could create illusion of worth/accuracy of risk assessment

- Uncertainty and variability of consequences/likelihood are to be considered and communicated

Cost Benefit Analysis #

- CBA: Cost Benefit Analysis

- ACS: Annualised Cost of Safeguard

- ALE: Annualised Loss Expectancy

- SLE: Single Loss Expectancy

- ARO: Annualised Rate of Occurence

CBA = ALE(prior) - (ALE(post) + ACS)

ALE = SLE x ARO

| Risks | ALE (prior) | SLE | ARO | ALE (post) | ACS | CBA |

|---|---|---|---|---|---|---|

| A | $26k | $500 | 12x | $6k | $3k | $17k |

| C | $25k | $75k | 0.1x | $7.5k | $5k | $12.5k |

Risk Treatment Options #

- Retain/Accept: Organisation may tolerate (but not ignore) risk

- Avoid/Terminate: Organisation may decide nto to do the thing that incurs risk

- Share/Transfer: Transfer risk via an insurance policy or a third party

- Modify/Reduce: Adopt controls to lower the current level of risk

- by reducing likelihood

- by reducing impact

Critical Appraisal of Risk Methods and Frameworks #

This was originally produced by NCSC so practioners and decision makers can better understand and work with the approaches available.

- Limits of a ‘reductionist’ approach

- Lack of variety

- Limits of a ‘fixed state’ approach

- Lack of feedback and control

- Losing risk signals in the ‘security noise’

- System operation

- Information opacity

- Noise from misguided analysis

- Noise from bias

- Assumed determinability

- Abstraction through labelling

- The limits of using matrices

- Limits in the way uncertainty is presented

- The effect risk relationships have on impact

- The adverse effect of intervention

- Impacts are not limited to the scope of assessment

- The effect of time on risk